Introduction: The Era of Proactive Accountability

The regulatory landscape for cybersecurity is undergoing a radical shift. Compliance has historically been treated as a static checklist a hurdle to clear before moving on. However with major directives and national legislation coming into effect in 2026 compliance is transforming into a continuous mandatory and proactive risk management strategy. For organisations operating across the EU and UK the stakes are higher than ever with significant turnover based penalties looming.

The regulatory landscape for cybersecurity is undergoing a radical shift. Compliance has historically been treated as a static checklist a hurdle to clear before moving on. However with major directives and national legislation coming into effect in 2026 compliance is transforming into a continuous mandatory and proactive risk management strategy. For organisations operating across the EU and UK the stakes are higher than ever with significant turnover based penalties looming.

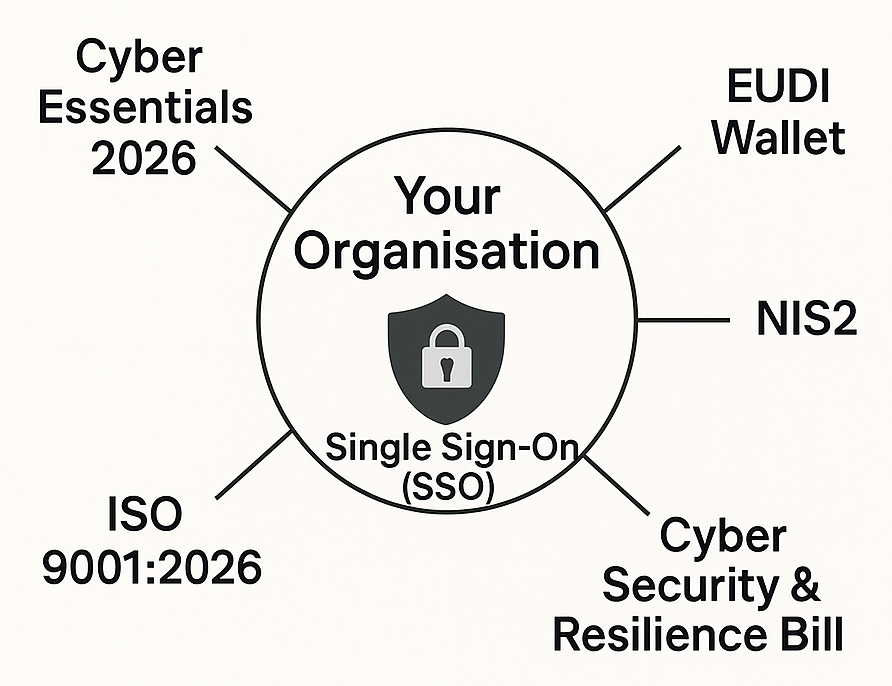

At the heart of this change lies Identity and Access Management IAM. Single Sign On SSO is no longer merely an efficiency tool to boost user experience it is rapidly becoming the central control point required to meet the strict access logging and Multi Factor Authentication MFA mandates being enforced globally. This transition marks a critical compliance inflection point.

The UK Regulatory Tightening: MFA and Resilience

The United Kingdom is strengthening its core cyber hygiene standards and introducing legislation to hold providers of essential services more accountable.

Cyber Essentials 2026: Mandatory MFA for Cloud Services

Starting in April 2026 the updated Cyber Essentials scheme will cement the role of Multi Factor Authentication MFA as a non negotiable security control.

The key change is that if a cloud service offers MFA capabilities it must be enabled for all users across the organisation entire scope or the organisation will automatically fail its assessment. This change removes any previous ambiguity and reinforces best practises in identity security. This updated requirement directly impacts Single Sign On as SSO is the most effective and scalable mechanism to centrally enforce MFA across all connected cloud applications ensuring consistency and preventing application silos from becoming weak links. Furthermore the updated scheme promotes the adoption of passwordless authentication methods like FIDO2/Passkeys which align perfectly with modern SSO strategies.

The Cyber Security and Resilience Bill

This new UK legislation dramatically expands the scope and severity of penalties for serious cybersecurity breaches. The rules introduce much greater scrutiny for Managed Service Providers MSPs and technology suppliers requiring them to manage cyber risk proactively.

The Bill increases potential fines significantly up to the higher of £17 million or 4 per cent of worldwide turnover and critically tightens incident reporting obligations. Organisations will need to provide an initial notification of harmful incidents within 24 hours. This immediate demand for accurate incident data makes centralised SSO crucial as it provides instant accurate identity audit logs the source of truth required for prompt investigation and regulatory reporting.

The EU Identity Revolution: eIDAS 2.0 and NIS2

The European Union is preparing for a systemic overhaul of digital identity and network security both of which mandate a robust IAM backbone.

eIDAS 2.0 and the European Digital Identity EUDI Wallet

The revised eIDAS 2.0 Regulation mandates that EU Member States must make a European Digital Identity EUDI Wallet available to its citizens by 2026.

This wallet will empower citizens with selective control over which personal attributes e.g. age professional qualifications they share digitally enhancing privacy and user control. For businesses particularly those operating in regulated sectors or those offering public and private services across borders compliance requires the capability to accept and integrate with this new federated identity standard. Modern SSO systems leveraging standard protocols like SAML and OAuth 2.0 will be essential for creating the trust frameworks necessary to consume these EUDI Wallets seamlessly and compliantly.

NIS2 and Board Level Accountability

While the NIS2 Directive was adopted earlier its full implementation and the related national strategies are shaping the 2026 landscape. NIS2 significantly expands the list of critical sectors including digital infrastructure like cloud services and data centres and mandates a higher common level of cybersecurity ambition.

The directive emphasises risk management measures and significantly introduces accountability for top management for non compliance. By implementing centralised SSO organisations satisfy NIS2s demand for robust access controls secure supply chain management by managing third party access and comprehensive logging necessary to demonstrate due diligence to regulators.

Global Alignment: ISO Standards and Digital Trust

Beyond government led mandates global certification standards are also evolving to incorporate digital era risks.

ISO 9001:2026 and Digitalisation Controls

The revision of the worlds leading Quality Management System QMS standard ISO 9001:2026 expected Q3/Q4 2026 will specifically integrate modern business considerations such as digitalisation Artificial Intelligence AI and data driven processes.

Organisations will be required to demonstrate comprehensive cybersecurity controls and validation for its digital platforms. SSO directly addresses this ensuring that only verified authorised and appropriately permissioned identities can interact with the critical systems that underpin the organisation quality and operational integrity.

Strategic Identity Consolidation for Compliance Readiness

Achieving readiness for the 2026 compliance cycle requires a strategic approach to identity infrastructure rather than simply adopting point solutions. Organisations must prioritise identity consolidation to ensure auditability and consistent enforcement of security policies.

Effective identity consolidation through SSO ensures:

- MFA Universality: Consistent application of Multi Factor Authentication across the entire application portfolio meeting Cyber Essentials non negotiable requirement.

- Granular Audit Trails: Detailed immutable access logs for rapid and accurate incident response a necessity for the stringent reporting timelines mandated by the Cyber Security and Resilience Bill and NIS2.

- Federation Readiness: The architectural flexibility to integrate new identity standards such as the European Digital Identity EUDI Wallet using established protocols like SAML and OAuth 2.0.

Identity consolidation is the technical mechanism that allows organisations to transition from reactive compliance to proactive risk governance a key theme across all new regulations.

Key Takeaways: The Foundational Pillar of Digital Governance

The year 2026 represents a pivotal moment in the governance of digital identity. The confluence of the UKs mandatory MFA requirements the EUs groundbreaking federated identity architecture and the increase in executive accountability fundamentally redefines the role of Identity and Access Management.

Centralised Single Sign On is therefore not an optional investment but a foundational pillar of modern digital governance. It provides the necessary security controls the audit readiness and the architectural flexibility to meet these complex global mandates simultaneously. Organisations that fail to centralise their access controls assume a substantial strategic liability that will directly translate into regulatory non compliance and severe financial exposure. Prioritising robust SSO implementation today is the definitive action for futureproofing business operations.

If you are unsure where to begin or would like expert guidance in aligning your access strategy with 2026 regulatory expectations, our team is here to help. Reach out through the contact button and we will walk you through the best approach for your organisation.